Brand Talks Berlin 2018: When the interaction is the product.

What if what you’re selling isn’t really a thing at all?

This is the question that Lorenz Seeger, of diesdas.digital, and Kai Diekmann, founder of Der Zukunftsfonds, confronted during the 2018 Brand Talks program at TYPO Berlin.

Seeger and Deekman worked together on Der Zukunftsfonds, a new online financial service in Germany. They quickly determined that perhaps their biggest challenge would be figuring out how to get Germans to talk about money.

Germans prefer flexibility and stability over profit, Diekmann explained, which makes it difficult to even start a conversation about new, alternative (and potentially lucrative) financial products. “Germans don’t want to think about money or even talk about money,” Diekmann said. “80% of millenials would rather go to the dentist than talk to someone in a bank.”

Focus on the conversation

It became clear that in order to sell Der Zukunftsfonds, the company also needed to sell the idea of talking about money. Seeger explained that, “in the beginning, we asked, ‘How can we approach the issue of money being a taboo?’ We wanted to get people thinking about their money, then lift the taboo and give it more energy.”

Der Zukunftsfonds launched a digital magazine called Zaster, which roughly translates as “cash,” aimed at loosening up the conversation around money. Instead of market analysis and financial jargon, the content focuses on planning for life events like having a child, presented in language that can be understood easily.

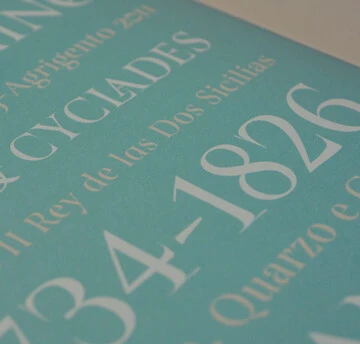

Zaster exists as its own product, available to customers and non-customers alike. But it also exists within a network of Der Zukunftsfonds touchpoints, all of which are linked by cohesive branding that uses primary colors and bold fonts to establish a non-traditional personality—for the finance sector, at least.

This approach gives Der Zukunftsfonds’ tech-savvy customers the flexibility they want and expect. As Deikmann pointed out, millennials (and even many non-millenials) resent being forced to go to a bank. Taking the entire banking experience online and allowing customers to familiarize themselves not just with specific funds but with investing and finance in general is a no brainer.

Der Zukunftsfonds’ use of a loose but cohesive font strategy also lets them adapt as customer preferences change. What’s popular today may be replaced by something new tomorrow, and modern brands need to be ready to follow their customers to these new platforms and environments.

“Everyone knows what a fund is”

The central bet here is that Der Zukunftsfonds’ isn’t really selling investment funds. Or rather, that it isn’t enough to simply sell investment funds, especially given the specific challenges presented by its German customers. Instead, Der Zukunftsfonds realized it needed to build from the customer out by creating dialogue first and focusing on the product second.

“The interaction is the product,” Seeger said. “Everyone [already] knows what a fund is, or a lot of people do. We need to focus on the discussion around the topic of the product and not focus too much on the product itself.”